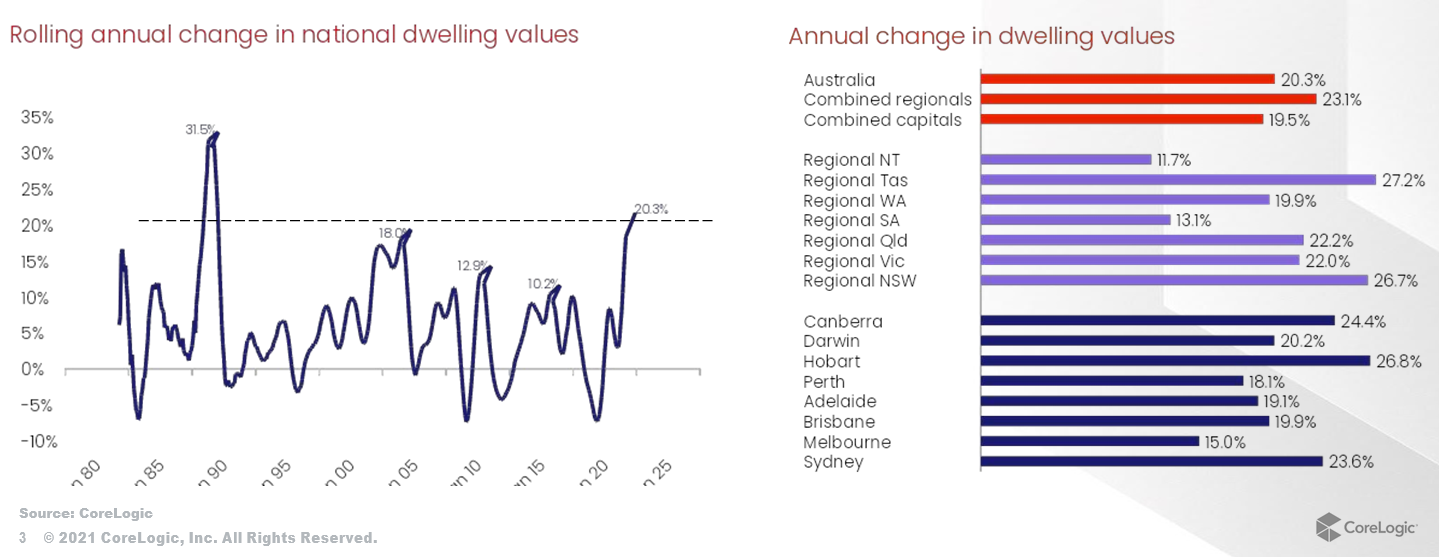

Australian housing values have surged higher, rising at the fastest annual pace since 1989.

Growth conditions have been broad based, with every capital city and regional area recording double digit annual gains in value.

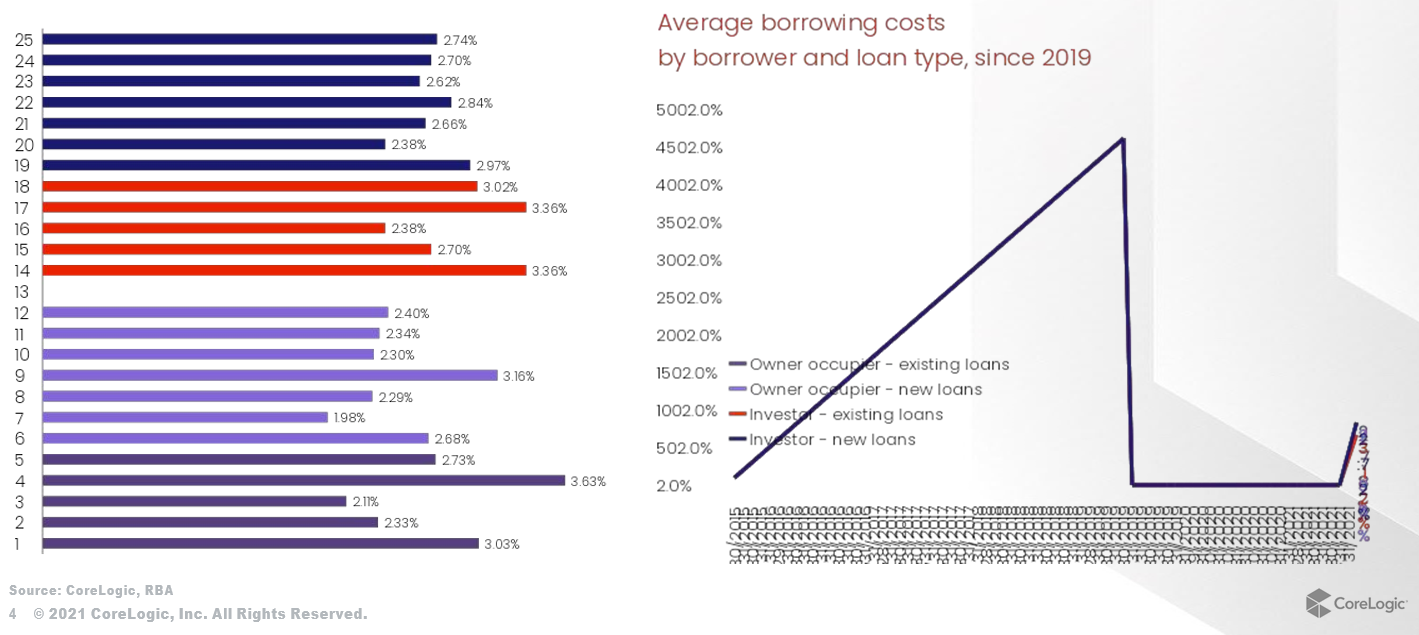

Record low mortgage rates have been central to the lift in housing demand

Sales volumes rose an estimated 41.9% in the year to September and were trending 25% above the 5yr average in September

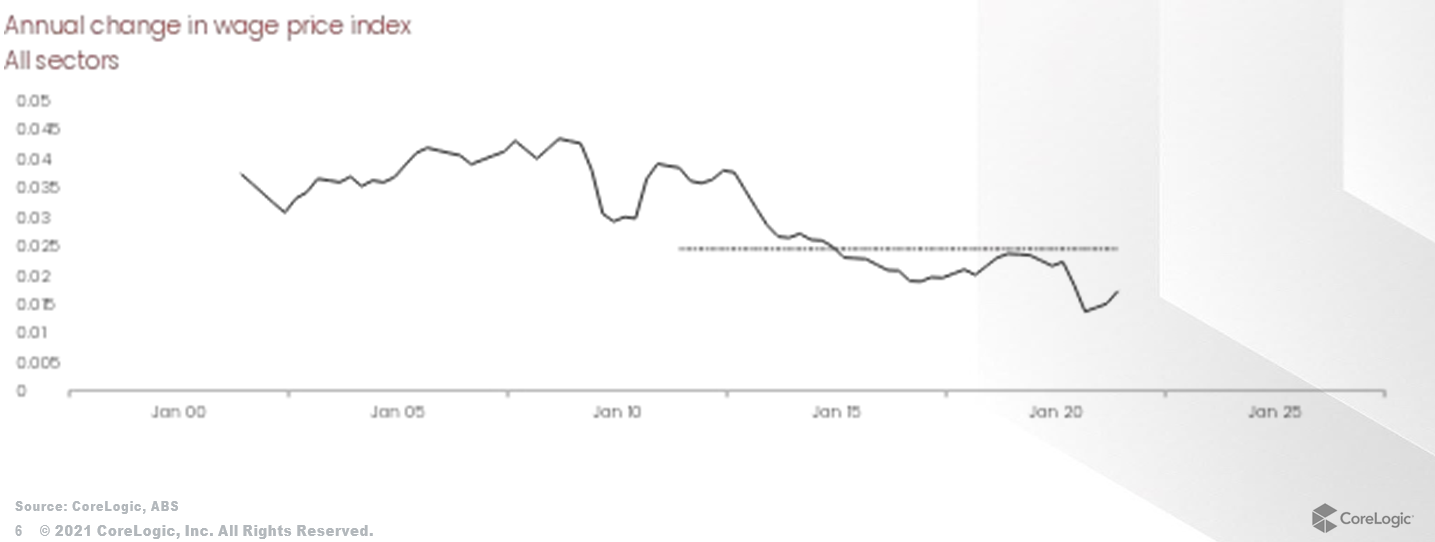

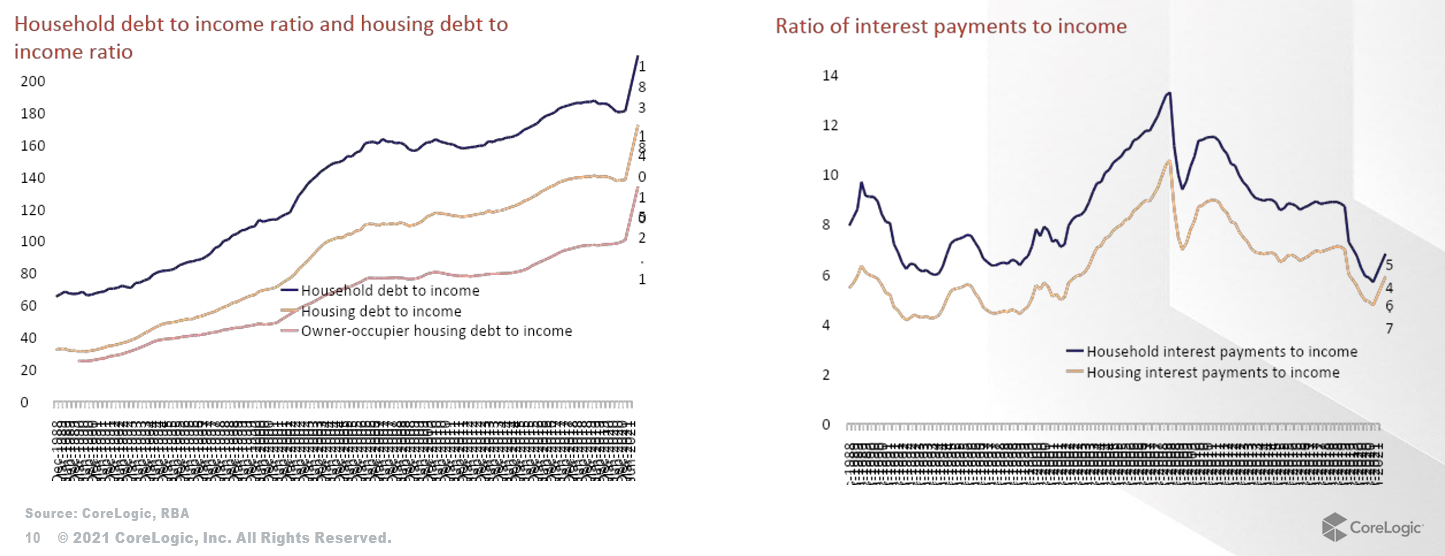

The high rate of growth in housing values and housing credit growth is occurring against a backdrop of below average income growth

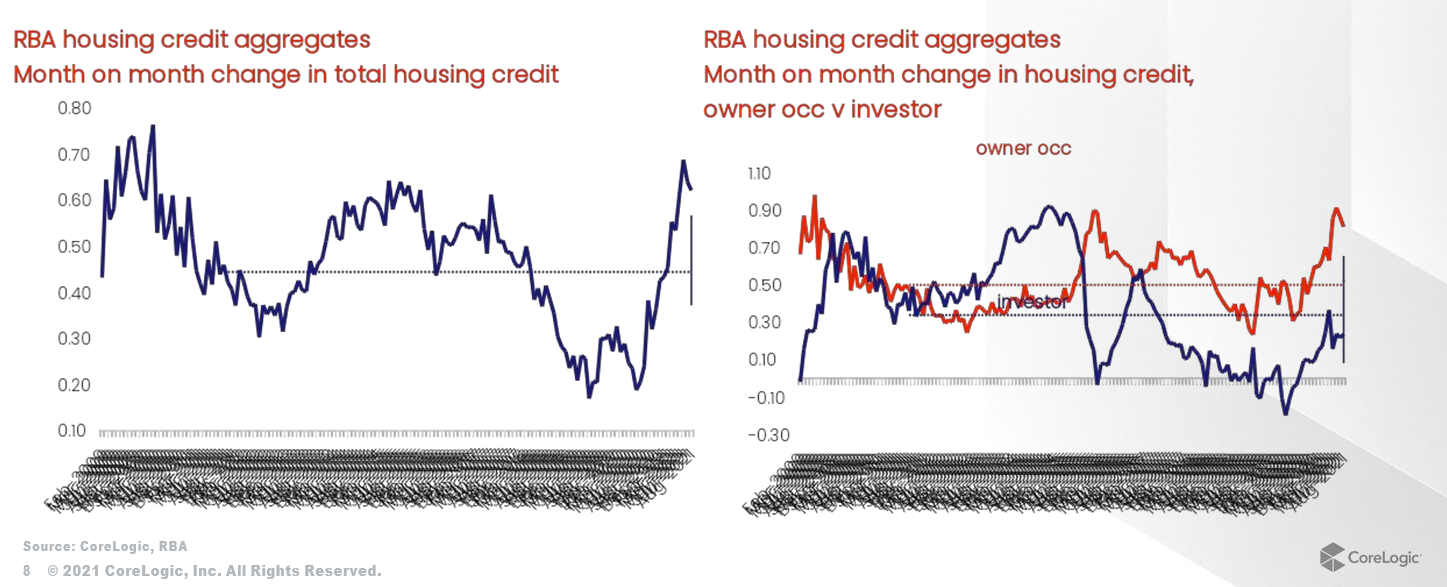

Surging housing values and sales activity has been accompanied by a sustained lift in housing credit.

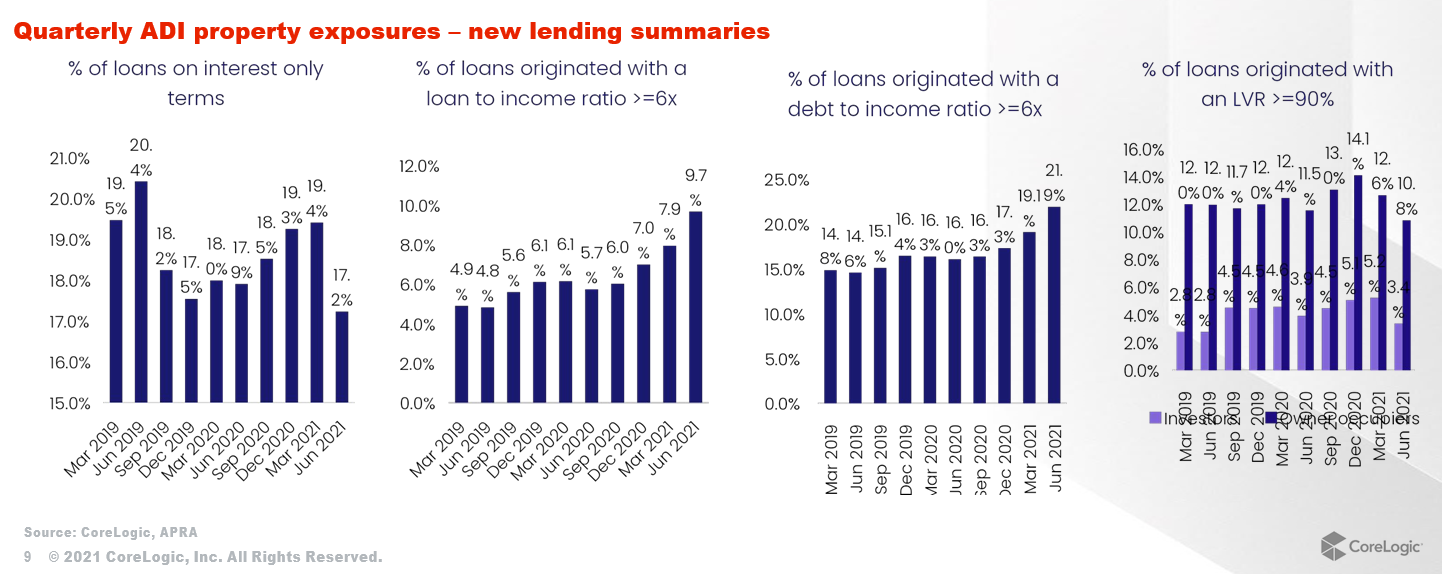

With low income growth, housing debt is around record highs and a larger than normal portion of borrowers have have high debt levels relative to their incomes.

The surge in housing activity has been accompanied by a sustained period of above average housing credit growth

…and lending to borrowers with high debt relative to their incomes has risen to be more than one in five home loans in Q2

Owner occupier housing debt reached a new record high in the June quarter, while housing debt relative to income was only 24 basis points from record highs.

Together with other factors such as worsening housing affordability, fewer incentives, higher supply and potentially slowing demand, tighter credit conditions are another factor likely to weigh on housing conditions

What is macroprudential?

Essentially, macroprudential policies are rules relating to credit issuance aimed at containing financial risks that could have a broader impact on the financial sector and economy.

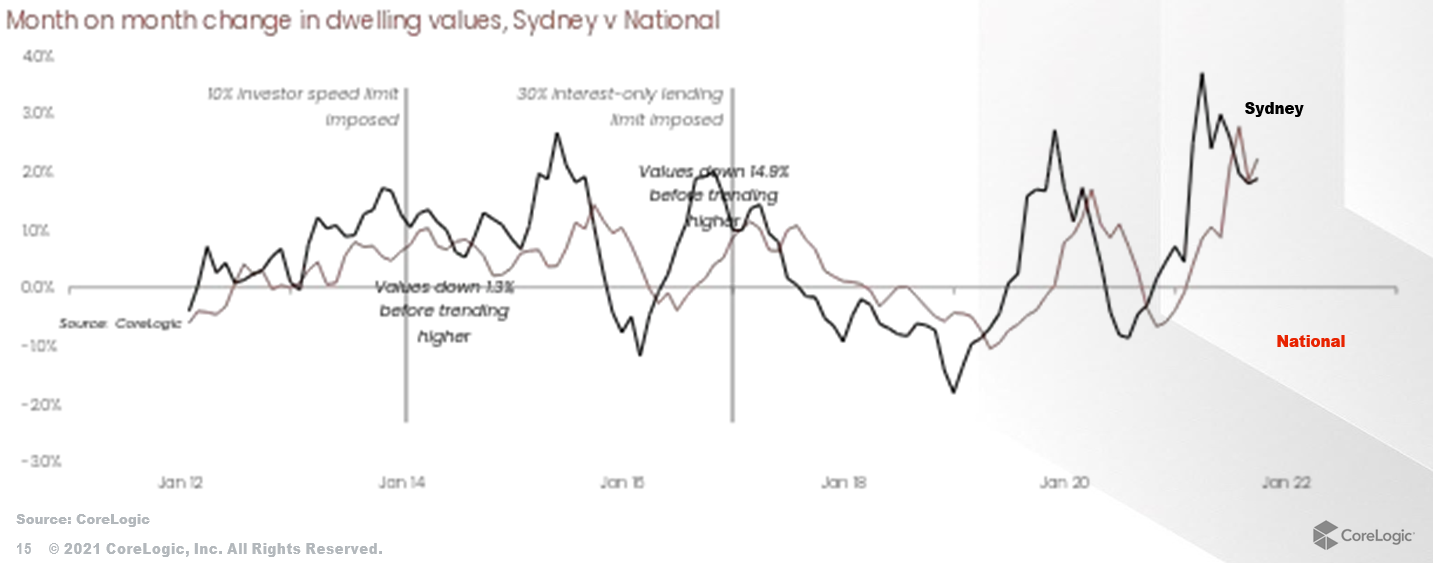

• Australia previously implemented macroprudential policies. Initially in December 2014, when APRA imposed a 10% speed limit on investor credit growth and subsequently in March 2017 with rules limiting interest only lending to 30% of new housing loan originations.

- New Zealand has been more aggressive with macroprudential policies, implementing (and revising) loan-to-valuation ratio restrictions since 2013 and will be consulting on implementing debt serviceability restrictions such as debt-to-income ratio

- Owner occupiers will generally need a 20% deposit from Nov 1st (only 10% of loans are exempt)

- Investors generally need a 40% deposit (only 5% of loans are exempt)

- New builds are exempt from LVR

New Zealand: LVR policy changes have been the catalyst for an inflection point in the housing cycle

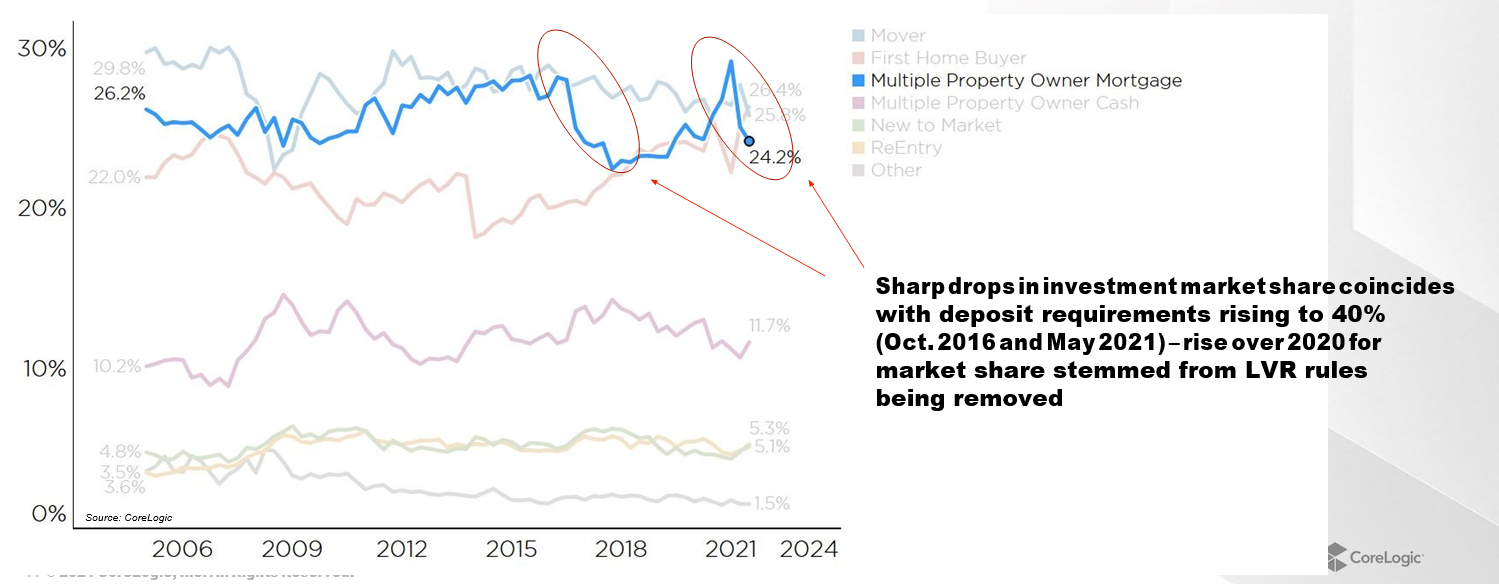

New Zealand: Investor demand falls sharply due to 40% deposit requirement

Owner occupiers soon to see tightening too – less low deposit lending

Buyer Classification – % share of NZ property purchases

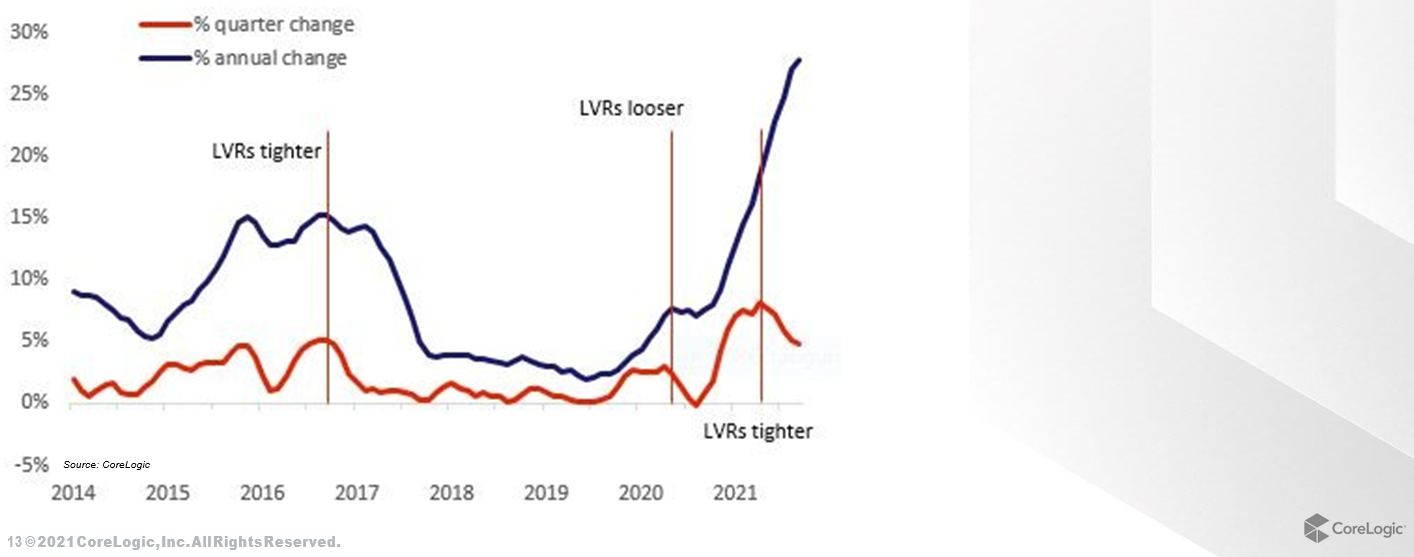

How did markets react to the last round of Australian credit tightening?

Policy changes were focused on investment lending and interest only lending and had a more pronounced impact in areas of the market where investment was most concentrated.

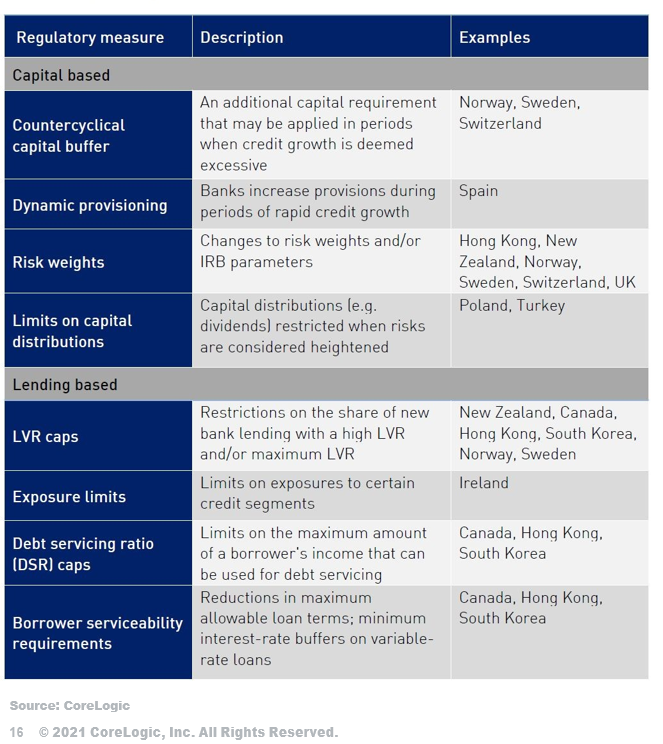

Table 1: Regulatory options to address housing market risks internationally

APRA has a range of options to consider when implementing macroprudential policy

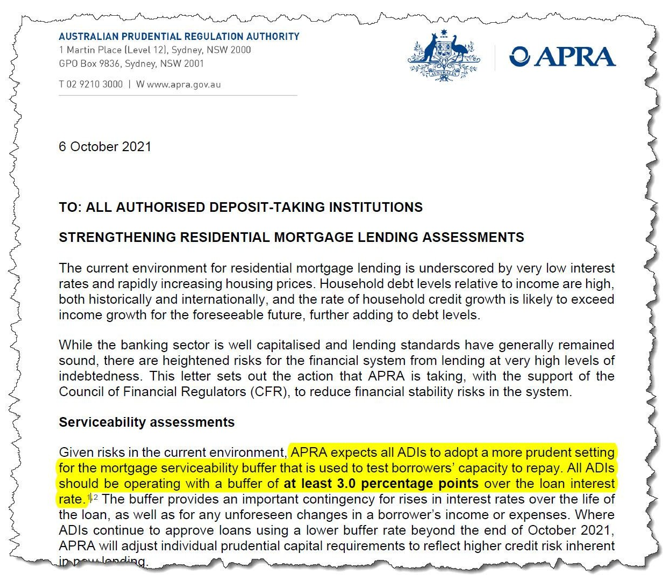

APRA chose to focus on borrower serviceability…

- The higher serviceability buffer reduces the maximum loan size for all borrowers… on average by about 5%

- The impact will be larger for borrowers with existing debt, as the buffer is applied to overall debt levels rather the just the loan being applied

- The impact will be less for borrowers with low existing debt and/or high levels of net income

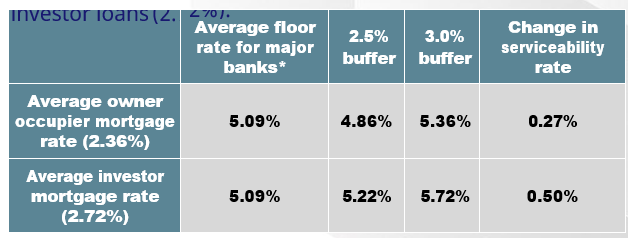

Comparison of the change to interest rate assessment based on the current average mortgage rate for new owner occupier loans (which was 2.36% through August) and

Disclaimer

In compiling this publication, RP Data Pty Ltd trading as CoreLogic has relied upon information supplied by a number of external sources. CoreLogic does not warrant its accuracy or completeness and to the full extent allowed by law excludes liability in contract, tort or otherwise, for any loss or damage sustained by subscribers, or by any other person or body corporate arising from or in connection with the supply or use of the whole or any part of the information in this publication through any cause whatsoever and limits any liability it may have to the amount paid to CoreLogic for the supply of such information.

Queensland Data

Based on or contains data provided by the State of Queensland (Department of Natural Resources and Mines) 2021. In consideration of the State permitting use of this data you acknowledge and agree that the State gives no warranty in relation to the data (including accuracy, reliability, completeness, currency or suitability) and accepts no liability (including without limitation, liability in negligence) for any loss, damage or costs (including consequential damage) relating to any use of the data. Data must not be used for direct marketing or be used in breach of the privacy laws.

South Australian Data

This information is based on data supplied by the South Australian Government and is published by permission. The South Australian Government does not accept any responsibility for the accuracy or completeness of the published information or suitability for any purpose of the published information or the underlying data.

New South Wales Data

Contains property sales information provided under licence from the Land and Property Information (“LPI”). CoreLogic is authorised as a Property Sales Information provider by the LPI. Victorian Data

The State of Victoria owns the copyright in the Property Sales Data which constitutes the basis of this report and reproduction of that data in any way without the consent of the State of Victoria will constitute a breach of the Copyright Act 1968 (Cth). The State of Victoria does not warrant the accuracy or completeness of the information contained in this report and any person using or relying upon such information does so on the basis that the State of Victoria accepts no responsibility or liability whatsoever for any errors, faults, defects or omissions in the information supplied.

Western Australian Data

Based on information provided by and with the permission of the Western Australian Land Information Authority (2021) trading as Landgate. Australian Capital Territory Data

The Territory Data is the property of the Australian Capital Territory. No part of it may in any form or by any means (electronic, mechanical, microcopying, photocopying, recording or otherwise) be reproduced, stored in a retrieval system or transmitted without prior written permission. Enquiries should be directed to: Director, Customer Services ACT Planning and Land Authority GPO Box 1908 Canberra ACT 2601.

Tasmanian Data

This product incorporates data that is copyright owned by the Crown in Right of Tasmania. The data has been used in the product with the permission of the Crown in Right of Tasmania. The Crown in Right of Tasmania and its employees and agents:

a) give no warranty regarding the data’s accuracy, completeness, currency or suitability for any particular purpose; and

b) do not accept liability howsoever arising, including but not limited to negligence for any loss resulting from the use of or reliance upon the data